The road to a successful India-EU investment protection agreement is going to be bumpy largely because of India’s inward-looking approach to investment protection under international law as enunciated in India’s 2016 Model bilateral investment treaty.

Author

Prabhash Ranjan, Professor and Vice Dean, Jindal Global Law School, O.P. Jindal Global University, Sonipat, Haryana, India.

Summary

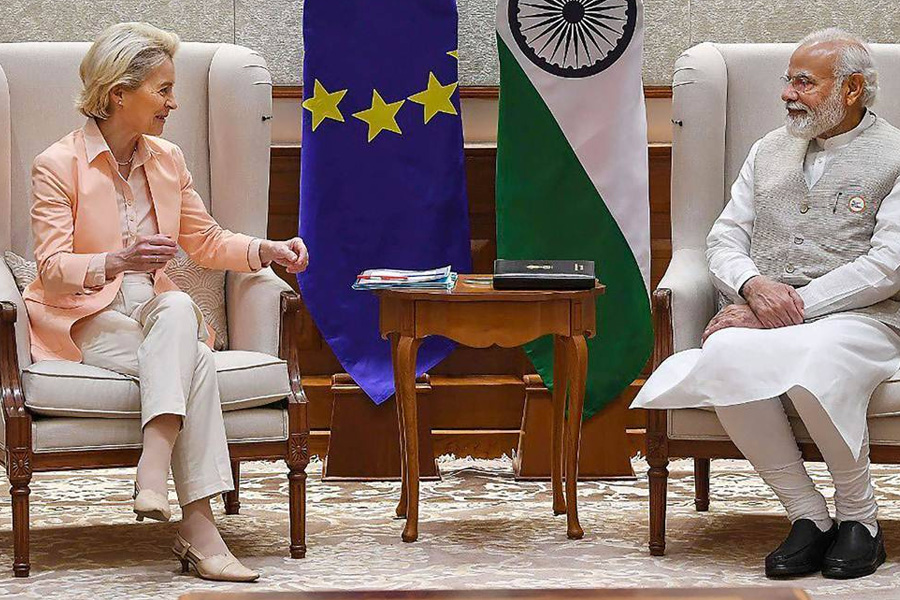

The third round of negotiations of the India-European Union (EU) free trade agreement concluded recently. The two sides are also negotiating an investment protection agreement (IPA), which will contain investment protection standards and an independent mechanism to settle disputes between investors and states under international law.

Notwithstanding the laudable intent of the government to welcome them, foreign investors in India have often got into numerous regulatory troubles with the state. Several foreign corporations like Vodafone, Cairn Energy, Nissan, White Industries, Telenor, Nokia, Vedanta have sued India to enforce the rights guaranteed to them in bilateral investment treaties (BITs). This is the main motivation behind the EU seeking an IPA with India. Arguably, EU investors can rely on Indian law for protection. But Indian law can be unilaterally changed to the detriment of the investor. Moreover, the Indian judiciary is agonisingly slow in resolving disputes. Thus, the longing for protection under international law.

But the road to a successful India-EU IPA is going to be bumpy largely because of India’s inward-looking approach to investment protection under international law as enunciated in India’s 2016 Model BIT. The following differences between the two sides are daunting.

Published in: The Indian Express

To read the full article, please click here.